CALGARY, ALBERTA – DECEMBER 20, 2022 – West High Yield (W.H.Y.) Resources Ltd. (“West High Yield” or the “Company“) (TSXV:WHY) is pleased to announce the confirmation of additional high- grade gold assays (see Table 1) including the identification of visible native gold in drill core from DDH MN22-13 (see Figures 1 and 2) and to provide an update from the 2022 6,000 metre exploration drilling program (the “2022 Program“). The 2022 Program was completed and closed for the winter season on November 15th at the Company’s Midnight Gold claim (“Midnight“) located in the Rossland Gold Camp area, British Columbia (see Figure 3). The three drills at Midnight demobilized in October and November. A total of 6,197 metres were completed (see Table 2) during the course of the Program. The Rossland Gold Camp historically produced over 2.76 million ounces of recovered gold and 3.52 million ounces of recovered silver.

HIGHLIGHTS

- 41 holes completed in 6,197 metre NQ2 diamond drilling program

- Targets tested in historical Midnight, IXL and OK mining areas

- Additional high-grade gold assays including:

- MN22-13 72.35-72.65 metres depth – 154 g/t Au (visible gold)

- MN22-13 185.7-186.20 metres depth – 21.4 g/t Au (visible gold)

- MN22-08 38.7-39.4 metres depth – 15.85 g/t Au, and

- MN22-09 205.1-206.6 metres depth – 37.9 g/t Au

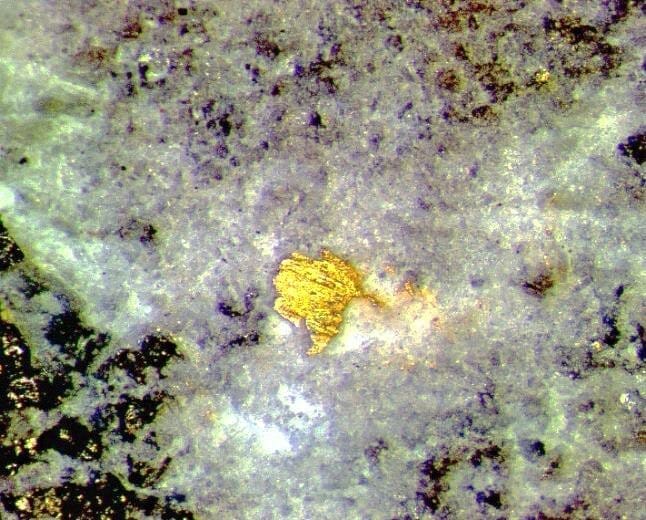

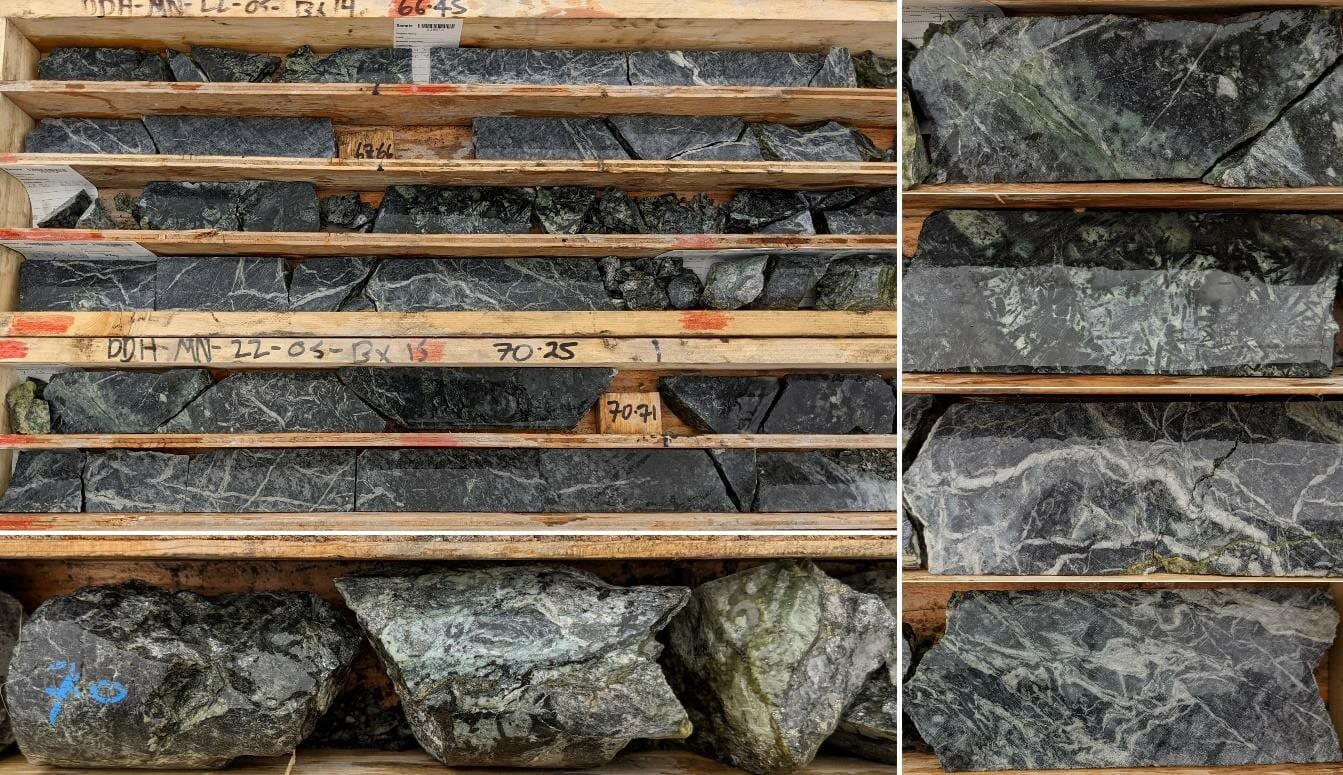

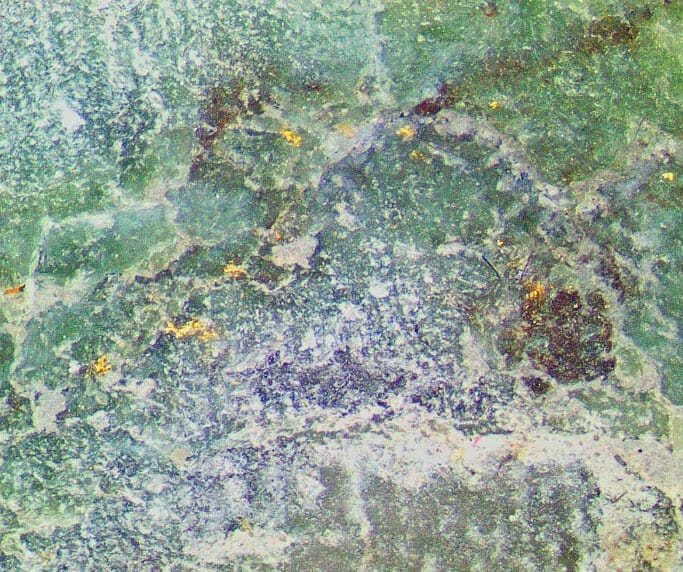

Figure 1. NQ2 diameter core showing two visible gold occurrences in MN22-13 72.35-72.65m. Gold grains range from <1mm to 4mm as irregular particles and aggregates disseminated or along microfractures mainly in listwanized peridotite (quartz, serpentine and carbonate with Fr-Cr oxide relicts). Gold also was noted with fine to coarse-grained aggregates of brecciated pyrite and dark green chlorite, serpentine and quartz. Field of view approximately 60mm (Left) and 20mm (Right). Assay – 154 g/t Au. SCR- 24B coarse fraction 9% of weight, 58 wt.% of the gold.

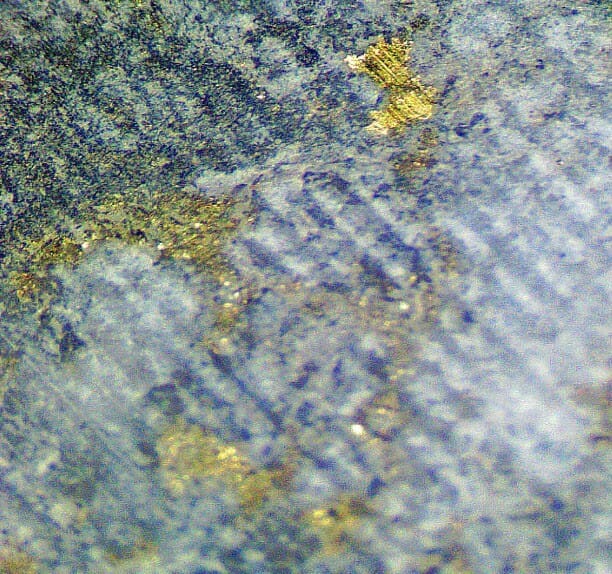

“We continue to intersect structurally-controlled mineralization with visible gold (see Figures1 and 2) in high-grade assay intervals such as those in MN22-13 northwest of the central Midnight mineralization (see Tables 1 and 3). Assays using gravimetric and metallic screen protocols verified significant grades up to 154 g/t Au in narrow intervals from 30cm to 1.5 metres”, stated Greg Davison, P.Geo and QP for Midnight. “Screen metallics of the highest-grade interval confirmed 996 g/t Au in the coarse fraction which contributed 58% of the contained Au (MN22-13 72.4 metres).”

“The high-grade gold occurred mainly within variably deformed and serpentinized peridotite showing moderate to pervasive quartz-serpentine-carbonate (listwanite) replacement transected by discrete quartz- dominant veins to 50cm and sets of <1-10 mm veinlets with minor to sparse sulphides. Core intervals measuring up to 60 metres of massive, weakly altered peridotite, consistently with 5% to 10% disseminated to microfracture-controlled pyrite and/or pyrrhotite, intersected west of the Midnight and in the IXL, generally exhibited lower Au grades (0.2-2.0 g/t Au). Leapfrog 2D and 3D mapping, with current and historical drilling and underground workings, and recently flown high-resolution LiDAR topographic control, will be used to evaluate their geospatial significance in the mineralizing system”, said Mr. Davison. “Geological logging and 80% of the half-core sampling (2868 including QA/QC) were completed prior to the winter shutdown. The remaining core intervals will be processed in a Q2 2023 program. ”

Figure 2. Left – NQ2 diameter core showing visible gold occurrence in MN22-13 72.35-72.65m. Gold grains and aggregates range from <1mm to 4mm in quartz, serpentine and carbonate with abundant pyrite. Right – Close-up view with coarse gold grain. Field of view approximately 60mm (Left) and 15mm (Right). Assay – 154 g/t Au.

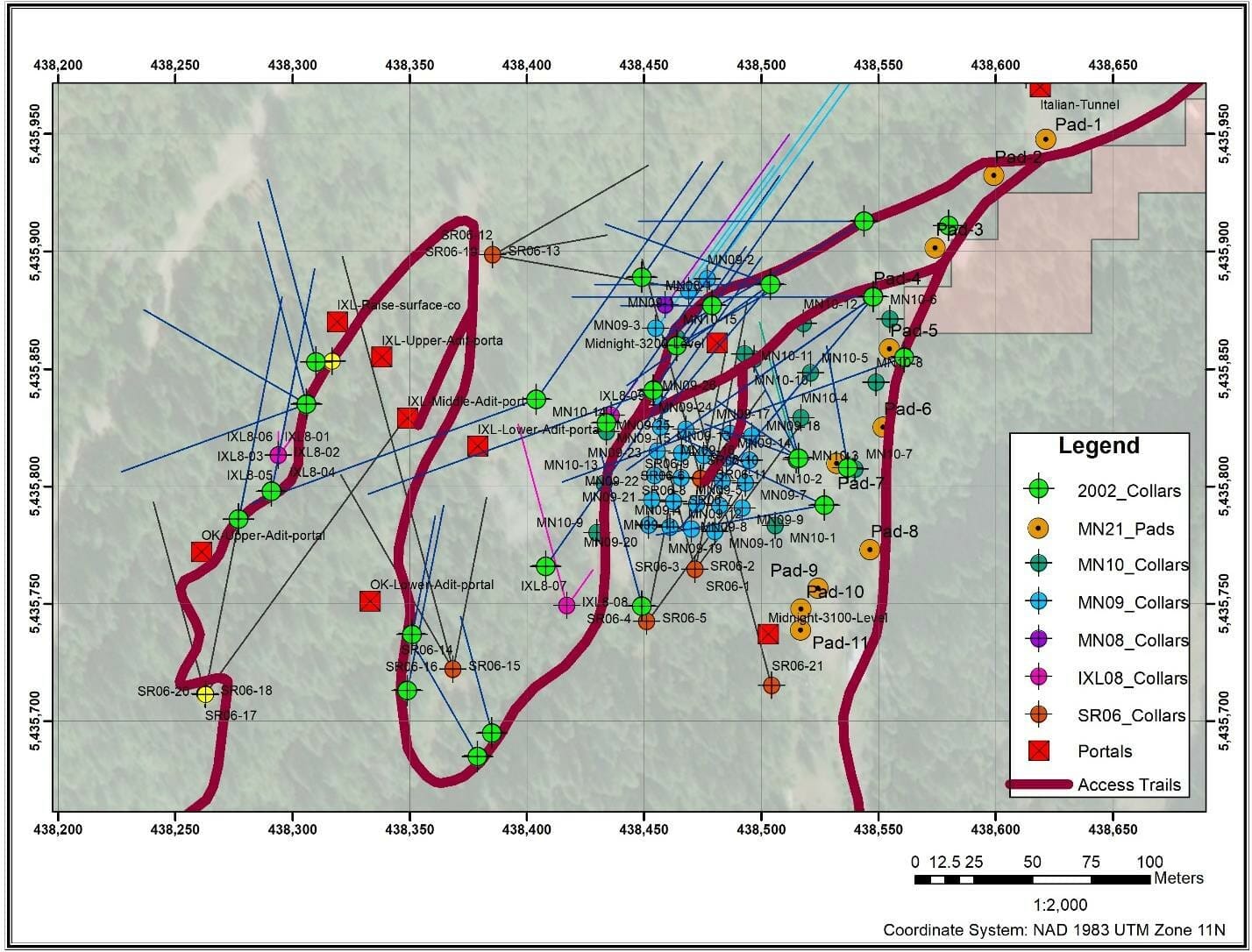

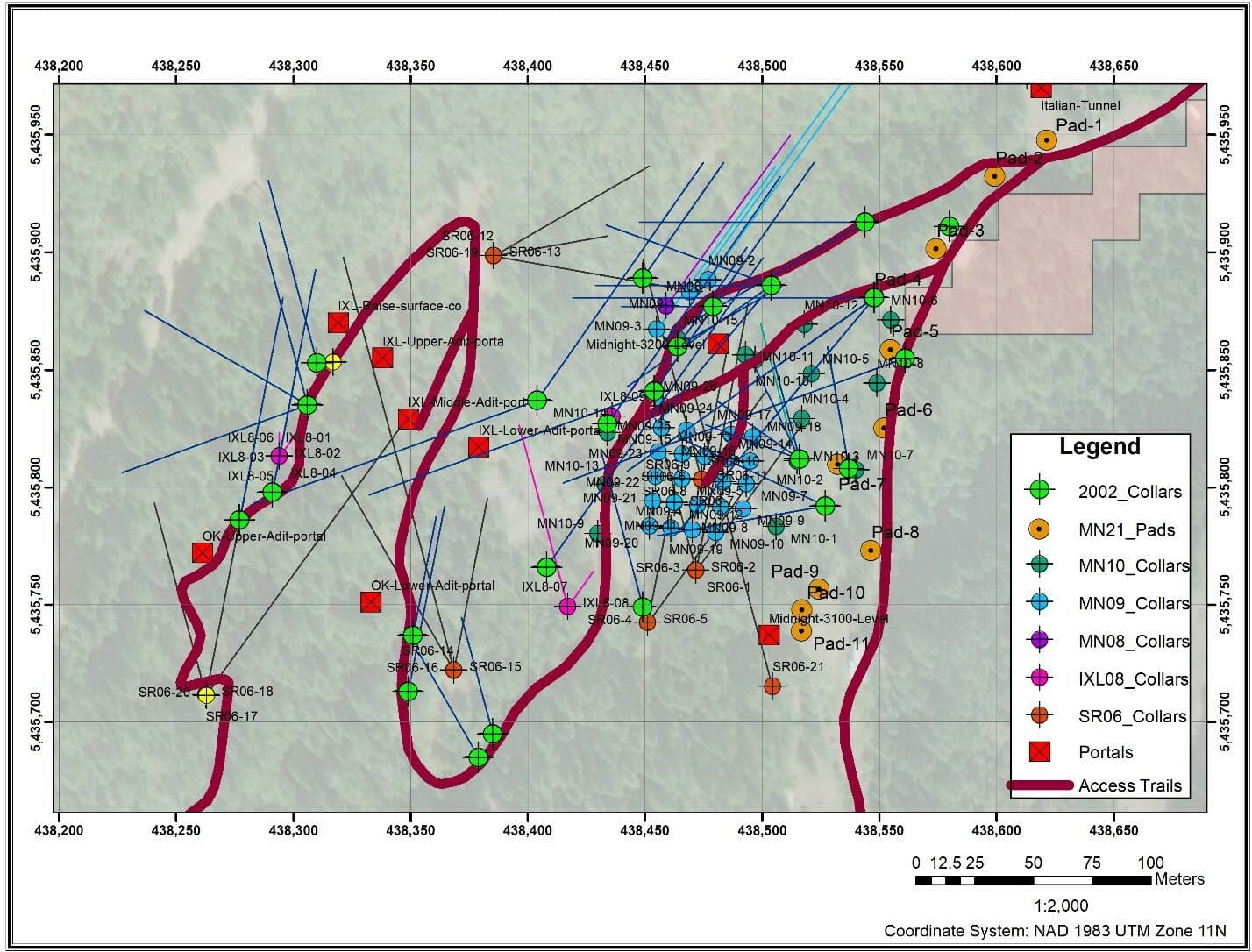

Figure 3 shows the distribution of the 2022 permitted and active drill collar locations relative to the 2006- 2010 drilling. A total of 31 collar locations are fully permitted for the current program. Assays received from 2077 core and QA/QC samples are reported to date for DDH MN22-01 through MN22-12, MN22- 19a and MN22-19B with partial results for MN22-13, MN22-14 and MN22-21. Results are pending for samples for DDH MN22-13 through MN22-18, MN22-20, MN22-21 and MN22-28. Fifteen holes (593 samples) await core cutting and sampling.

Geological compilation and Leapfrog modelling of the current and historical drill and geological results is underway while awaiting assay results from approximately 781 core samples.

Table 1. Summary of recent 2022 drill core intersections (MN22-05 to MN22-13 inclusive, MN22-19, MN22-21) with 2 gram- plus Au g/t values. Samples >10 g/t Au were finished using gravimetric analysis and/or screen metallics (highlighted).

| Hole # | Sample # | From (m) | To (m) | Au g/t* | Ag g/t |

| MN22-05 | 225694 | 84.85 | 86.35 | 2.81 | 0.5 |

| MN22-07 | 225845 | 44.25 | 45.30 | 5.39 | 3.8 |

| 225875 | 78.10 | 79.75 | 2.78 | 15 | |

| MN22-08 | 229012 | 38.70 | 39.40 | 15.85* | 2.5 |

| 229013 | 39.40 | 40.10 | 6.88 | 1.9 | |

| MN22-09 | 229313 | 82.95 | 83.90 | 3.75 | NA |

| 229333 | 106.95 | 108.45 | 7.23 | NA | |

| 229334 | 48.55 | 50.05 | 2.51 | NA | |

| 229335-38 | 56.10 | 61.85 | 3.74 | NA | |

| 229339 | 205.10 | 206.60 | 37.9* | 3 | |

| MN22-10 | 229171 | 84.40 | 85.90 | 2.17 | NA |

| 229172 | 85.90 | 87.40 | 3.13 | NA | |

| MN22-11 | 227824 | 60.40 | 61.90 | 2.14 | NA |

| MN22-13 | 228558 | 72.35 | 72.65 | 154** | NA |

| 228657 | 185.70 | 186.20 | 21.4** | NA | |

| MN22-14 | 229307 | 91.60 | 93.10 | 2.03 | NA |

| MN22-19B | 229348 | 77.00 | 78.50 | 2.92 | NA |

* Au GRA-21 FAA with gravimetric analysis for samples >10 g/t

**SCR24-B screen metallics, Au-AA26 FAA for samples with visible gold

Completed Holes Planned Holes Proposed Holes

Completed Holes Planned Holes Proposed Holes

Figure 3. Location map of 2022 and post-2000 historical drilling on Midnight, IXL and OK mining claims and grants with mine portals and access trails. Current drilling completed at OK South and Upper Portal, IXL Upper and Lower Adit, and Midnight 3100 and 3200 Portals SSW of the Italian Tunnel.

Table 2. 2022 Midnight Drilling Program – as of November 16, 2022.

| Hole # | Easting | Northing | Azimuth (°) | Inclination (°) | Elevation (m) | Total Depth (m) | Area |

| 22-01 | 438580 | 5435911 | 0 | -90 | 960 | 352.6 | Midnight |

| 22-02 | 438537 | 5435808 | 350 | -50 | 943 | 81.7 | Midnight |

| 22-03 | 438537 | 5435808 | 350 | -75 | 943 | 197.5 | Midnight |

| 22-04 | 438531 | 5435792 | 295 | -68 | 942 | 185 | Midnight |

| 22-05 | 438531 | 5435792 | 260 | -50 | 942 | 113.4 | Midnight |

| 22-06 | 438531 | 5435792 | 260 | -70 | 942 | 139.8 | Midnight |

| 22-07 | 438548 | 5435881 | 290 | -50 | 962 | 245 | Midnight |

| 22-08 | 438561 | 5435855 | 260 | -75 | 956 | 276 | Midnight |

| 22-09 | 438548 | 5435881 | 235 | -50 | 962 | 241.85 | Midnight |

| 22-10 | 438548 | 5435881 | 295 | -50 | 962 | 158 | Midnight |

| 22-11 | 438548 | 5435881 | 295 | -70 | 962 | 218 | Midnight |

| 22-12 | 438277 | 5435786 | 11 | -50 | 1038 | 230 | OK |

| 22-13 | 438443 | 5435828 | 220 | -75 | 985 | 513 | Midnight |

| 22-14 | 438580 | 5435911 | 180 | -60 | 960 | 135 | Midnight |

| 22-15 | 438291 | 5435798 | 11 | -50 | 1051 | 36 | OK |

| 22-16 | 438291 | 5435798 | 340 | -50 | 1051 | 208.8 | OK |

| 22-17 | 438291 | 5435798 | 340 | -70 | 1051 | 226.6 | OK |

| 22-18 | 438461 | 5435739 | 340 | -50 | 970 | 207 | IXL south |

| 22-19A | 438461 | 5435739 | 320 | -50 | 970 | 21 | IXL south |

| 22-19B | 438461 | 5435739 | 290 | -50 | 970 | 153 | IXL south |

| 22-20 | 438580 | 5435911 | 180 | -60 | 960 | 117.6 | Midnight |

| 22-21 | 438306 | 5435835 | 345 | -50 | 1044 | 230 | OK |

| 22-22 | 438375 | 5435710 | 330 | -50 | 986 | 171 | OK south |

| 22-23A | 438306 | 5435835 | 11 | -60 | 1044 | 33 | OK |

| 22-23B | 438306 | 5435835 | 20 | -60 | 1044 | 32 | OK |

| 22-24 | 438375 | 5435710 | 330 | -70 | 986 | 153 | OK south |

| 22-25 | 438375 | 5435710 | 345 | -60 | 986 | 141 | OK south |

| 22-26 | 438443 | 5435828 | 220 | -60 | 985 | 192 | Midnight |

| 22-27A | 438551 | 5435796 | 260 | -50 | 940 | 19.8 | Midnight |

| 22-27B | 438551 | 5435796 | 260 | -50 | 940 | 43.4 | Midnight |

| 22-28 | 438580 | 5435911 | 220 | -50 | 960 | 124.35 | Midnight |

| 22-29 | 438443 | 5435828 | 190 | -60 | 985 | 96.45 | Midnight |

| 22-30 | 438551 | 5435796 | 345 | -50 | 940 | 26 | Midnight |

| 22-31 | 438443 | 5435828 | 240 | -60 | 985 | 210 | Midnight |

| 22-32 | 438449 | 5435889 | 185 | -60 | 996 | 25.5 | IXL Lower |

| 22-33A | 438463 | 5435866 | 220 | -50 | 975 | 51 | Midnight |

| 22-33B | 438463 | 5435866 | 220 | -60 | 975 | 72 | Midnight |

| 22-34 | 438449 | 5435889 | 220 | -60 | 996 | 228 | IXL Lower |

| 22-35 | 438580 | 5435911 | 220 | -70 | 960 | 124.35 | Midnight |

| 22-36 | 438548 | 5435881 | 220 | -60 | 962 | 143 | Midnight |

| 22-37 | 438449 | 5435889 | 35 | -60 | 996 | 24 | IXL Lower |

The 2022 Program was focused on identifying extensions to zones of known Midnight mineralization, areas with potential within and peripheral to the OK and IXL historical mines, and deep targets below the known footprint of mineralization (Figure 1). The drilling initially collared around the Midnight mine workings on targets from surface to 200 metres depth located to the southeast, east and north of the historical high- grade Baker Vein. These geological targets occurred within and peripheral to the Listwanite (quartz- carbonate-serpentine) zone which straddles the east-northeast trending fault contact between the OK ultramafic intrusion and the Jurassic-age andesite-dominant sequence to the north.

West High Yield brought in a second and third drill to expand the area of immediate interest outside the Midnight-Baker targets and to explore additional and deeper targets from 200 metres to more than 600 metres transecting the andesite-ultramafic contact and below the Baker Vein from the Midnight and neighbouring IXL claims.

The additional drills also targeted high-grade polymetallic Au-Ag-Cu-Pb, massive to stockwork-style silicified andesite-hosted mineralization with pyrrhotite and pyrite reported and observed from the OK Mine area historical drilling and is located between the OK Portal and the Upper Raise on the OK claim 50m east of the Cascade Highway.

Table 3. Summary of previously reported 2022 drill core intersections (MN22-01 to MN22-05 inclusive) with 4 gram-plus Au g/t values. Samples greater than 10 g/t Au were finished using gravimetric analysis and/or screen metallics (highlighted).

| Hole # | Sample # | From (m) | To (m) | Au g/t* | Ag g/t |

| MN22-02 | 212571 | 48.50 | 50.00 | 36.1 | 3.7 |

| 212583 | 65.00 | 66.50 | 7.94 | 1.4 | |

| 212584 | 66.50 | 68.00 | 17.9 | 9.6 | |

| 212585 | 68.00 | 69.50 | 8.61 | 2.3 | |

| 212587 | 69.50 | 71.00 | 22.6 | 31.2 | |

| MN22-03 | 212605 | 39.10 | 41.50 | 12.15 | 2.1 |

| 212606 | 39.10 | 41.50 | 13.6 | 1.6 | |

| 212621 | 60.00 | 61.50 | 20.7 | 6 | |

| MN22-04 | 225511 | 54.05 | 55.25 | 38.4 | 6.5 |

| MN22-05 | 225662 | 54.50 | 54.75 | 4.59 | 1.2 |

| 225664 | 55.65 | 57.15 | 8.44 | 1.9 | |

| 225666 | 58.65 | 60.15 | 15.7 | 2.9 | |

| 225667 | 60.15 | 61.65 | 14.3 | 1.6 | |

| 225674 | 68.40 | 69.45 | 33.7 | 3.5 | |

| 225677 | 69.95 | 70.25 | 311** | 94.9 | |

| 225681 | 70.25 | 71.30 | 4.37 | 4 |

* Au GRA-21 FAA with gravimetric analysis for samples >10 g/t

**SCR24-B screen metallics, Au-AA26 FAA for sample with visible gold

Gold mineralization in the Rossland area is reported to depths exceeding 750 metres and several faults transecting the area are interpreted to have significant vertical displacement. Fault repetition or imbricate stacking of the principal lithologies is indicated by the current drilling. The abundance of surface and underground workings, including adits and stopes, and the intense brittle deformation and serpentine-rich alteration of the peridotite, provided significant challenges for collaring and completing several holes in the program.

Geochemical Analysis, Quality Assurance and Quality Control

All core handling was conducted at the secure logging facility on Midnight. All samples were bagged and sealed with numbered security tags under the supervision of the QP and delivered to Overland Transport in Rossland for delivery to ALS Global (“ALS“) in North Vancouver, British Columbia for gold and multi- element analysis. ALS is a facility certified as ISO 9001:2008 and accredited to ISO/IEC 17025:2005 from the Standards Council of Canada. Metal values disclosed herein are reported principally from sawn (1/2) drill core samples over intervals of 30cm to 1.6 metres. Certain friable and broken intervals were processed using a rotary wedge core splitter. The remaining half-core samples are cross stacked on site. Local chain of custody was monitored and maintained directly by the QP and Project Geologist under the direction of the QP.

The samples were crushed to 70% passing 2mm (PREP-31) and a split of up to 250 grams pulverized to 85% passing 75 micrometres (-200 mesh). Pulps (50gram split) were submitted for Au analysis by Fire Assay with Atomic Absorption finish (Au-AA23). The retained pulps also were analyzed by Four Acid Digestion followed by Inductively Coupled Plasma Atomic Emission Spectrometry (ICP-AES) multi-

element analyses (ME-ICP61). Over-limit Au and Ag samples were analyzed by Fire Assay with Gravimetric Finish Ore Grade (Au-GRA21 or Au-GRA22, Ag-GRA21). Screen metallics assays were conducted on select ½ core samples to quantify gold distribution in the screen oversize (SCR-24B) and duplicate 50-gram pulps of the screen undersize (Au-GRA22). One 30cm sample of broken core with visible gold was sampled in its entirety through the SCR-24B protocol.

In-house quality control samples (blanks, standards, preparation duplicates) were inserted into the sample set using a protocol designed by the QP. ALS Global conducts its own internal QA/QC program of blanks, standards and duplicates, and the results are provided with the Company sample certificates. The results of the internal and ALS control samples are reviewed by the Company’s QP and evaluated for acceptable tolerances prior to disclosure. All sample and pulp rejects will be stored at ALS Global pending full review of the analytical data, and future selection of pulps for independent third-party check analyses, as requisite.

The Company’s Qualified Person (as hereinafter defined) believes that the sampling documentation, analytical protocols and quantitative data will withstand scrutiny for inclusion.

Qualified Person

Greg Davison, MSc, PGeo, Senior Consulting Geologist to West High Yield, is the Company’s internal qualified person (the “Qualified Person“) for Midnight and is responsible for approval of the technical content of this press release within the meaning of National Instrument 43-101 – Standards of Disclosure for Mineral Projects, under TSX Venture Exchange guidelines.

About West High Yield

West High Yield is a publicly traded junior mining exploration and development company focused on the acquisition, exploration, and development of mineral resource properties in Canada with a primary objective to develop its Record Ridge magnesium, silica, and nickel deposit using green processing techniques to minimize waste and CO2 emissions.

The Company’s Record Ridge magnesium deposit located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report prepared by SRK Consulting (Canada) Inc. in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact Information:

West High Yield (W.H.Y.) Resources Ltd.

Frank Marasco Jr., President and Chief Executive Officer Telephone: (403) 660-3488 Facsimile: (403) 206-7159 Email: [email protected]

Cautionary Note Regarding Forward-looking Information

This press release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation. The forward-looking statements and information are based on certain key expectations and assumptions made by the Company. Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; and other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date hereof, and to not use such forward-looking information for anything other than its intended purpose. The Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities of the Company will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) and may not be offered or sold within the United States or to, or for the account or benefit of U.S. persons except in certain transactions exempt from the registration requirements of the U.S. Securities Act.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.