CALGARY, ALBERTA – October 25, 2022 – West High Yield (W.H.Y.) Resources Ltd. (“West High Yield” or the “Company“) (TSXV:WHY) is pleased to announce that it has signed a non-binding memorandum of understanding (the “MOU“) with Big Blue Technologies LLC (“BBT“), a U.S. based technology company that has developed a green process to produce magnesium (“Mg“) ingots from magnesium oxide (“MgO“) and Mg ores, that contemplates, among other things, working towards entering into a definitive exclusive license agreement (the “License Agreement“) with BBT.

The MOU contemplates that the License Agreement shall, among other things, grant the Company an exclusive license (the “License“) to BBT’s intellectual property to build and operate a demonstrative magnesium processing facility in Canada (the “Demo Processing Facility“). Upon West High Yield’s successful completion of the Demo Processing Facility during the initial portion of the term of the License Agreement, the MOU contemplates that BBT will extend the exclusive License to West High Yield during the remaining term of the License Agreement in order to build, operate and/or sublicense one or more commercial magnesium processing facilities (the “Commercial Processing Facilities“), either by itself or through joint ventures with third parties, in North America, Central America, and South America.

In consideration of BBT granting the License to West High Yield, the MOU states that the License Agreement will provide BBT with a two (2%) percent royalty on West High Yield’s gross revenues derived from each of the Commercial Processing Facilities constructed by West High Yield during a specified time period to be set forth in the License Agreement.

The Company will issue a news release updating this information and providing more detail on the parties and finalized terms once the License Agreement has been entered into.

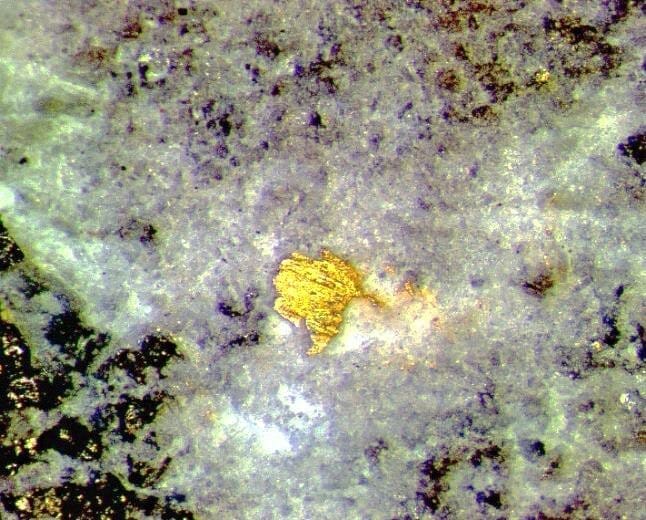

Frank Marasco Jr., President, and CEO of West High Yield states: “The Company has been looking for a green and economic technology to produce magnesium metal, and we are excited about working with the BBT team on the further development of their aluminothermic reduction process using West High Yield’s high-purity magnesia product to produce magnesium ingots, as shown in Figure 1. Magnesium as a strategic and critical metal is in high demand by onshore North American manufacturers who are seeking a safe, secure and reliable supply chain. The Unites States currently imports over 50% of their magnesium requirements, and the Company’s partnership with BBT will support its plans to be a supplier of choice for the underserviced demand.”

Figure 1. High-purity magnesium ingot sample that was produced using bench testing of BBT’s process using West High Yield’s MgO samples that were produced using the Company’s proprietary process from its Record Ridge Magnesium deposit located 10 kilometers southwest of Rossland, British Columbia

Aaron Palumbo, CEO of BBT, states: “The West High Yield team has demonstrated exceptional persistence to develop its Record Ridge magnesium property in Canada. The magnesia produced from its proprietary process on serpentine ore is an ideal feedstock for our technology to produce magnesium metal. With West High Yield’s magnesia and our electrified aluminothermic process, we have the potential to demonstrate the first net-zero magnesium metal production process. Our team is eager to press forward and be a part of West High Yield’s effort to establish magnesium metal production operations in North America and beyond.”

About Big Blue Technologies LLC

BBT is a Colorado-based limited liability company focused on developing high-temperature chemical processing solutions to aid in the production of magnesium ingots from magnesia feeds and other magnesium-bearing ores using aluminothermic reduction.

About West High Yield

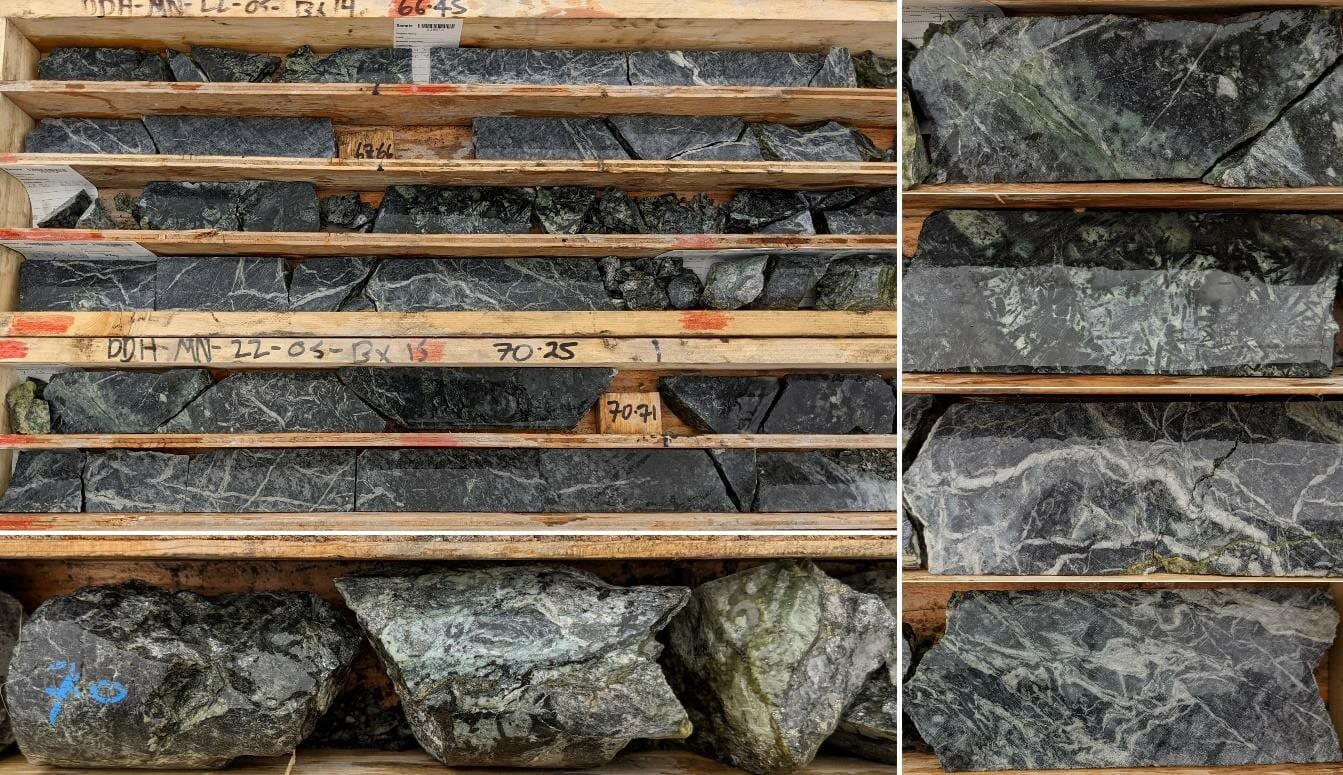

West High Yield is a publicly traded junior mining exploration and development company focused on the acquisition, exploration, and development of mineral resource properties in Canada with a primary objective to develop its Record Ridge magnesium, silica, and nickel deposit using green processing techniques to minimize waste and CO2 emissions.

The Company’s Record Ridge magnesium deposit located 10 kilometers southwest of Rossland, British Columbia has approximately 10.6 million tonnes of contained magnesium based on an independently produced preliminary economic assessment technical report prepared in accordance with National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

Contact Information:

West High Yield (W.H.Y.) Resources Ltd.

Frank Marasco Jr., President, and Chief Executive Officer Telephone: (403) 660-3488 Facsimile: (403) 206-7159 Email: [email protected]

Cautionary Note Regarding Forward-looking Information

This press release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation. The forward-looking statements and information are based on certain key expectations and assumptions made by the Company. Although the Company believes that the expectations and assumptions on which such forward-looking statements and information are based are reasonable, undue reliance should not be placed on the forward-looking statements and information because the Company can give no assurance that they will prove to be correct.

Forward-looking information is based on the opinions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking information. Some of the risks and other factors that could cause the results to differ materially from those expressed in the forward-looking information include, but are not limited to: general economic conditions in Canada and globally; industry conditions, including governmental regulation; failure to obtain industry partner and other third party consents and approvals, if and when required; the availability of capital on acceptable terms; the need to obtain required approvals from regulatory authorities; and other factors. Readers are cautioned that this list of risk factors should not be construed as exhaustive.

Readers are cautioned not to place undue reliance on this forward-looking information, which is given as of the date hereof, and to not use such forward-looking information for anything other than its intended purpose. The Company undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable law.

This press release does not constitute an offer to sell or a solicitation of an offer to buy any securities in the United States. The securities of the Company will not be registered under the United States Securities Act of 1933, as amended (the “U.S. Securities Act“) and may not be offered or sold within the United States or to, or for the account or benefit of U.S. persons except in certain transactions exempt from the registration requirements of the U.S. Securities Act.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OF THIS RELEASE.