CALGARY, ALBERTA–(Marketwire – Aug. 6, 2009) –

NOT FOR DISSEMINATION IN THE UNITED STATES OR TO US PERSONS.

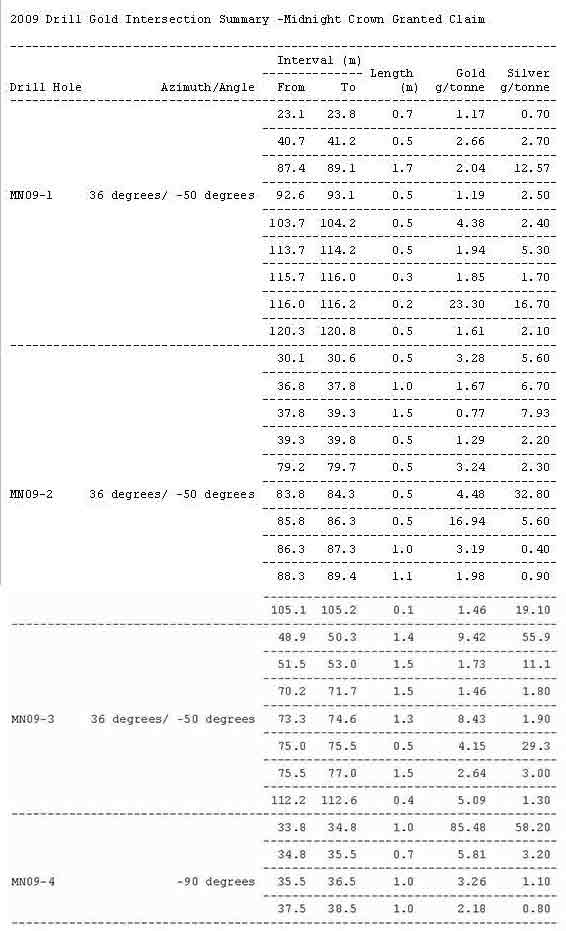

West High Yield (W.H.Y.) Resources Ltd. (“West High Yield” or the “Company”) (TSX VENTURE:WHY) announces that it has completed the first seven drill holes of its projected 20 exploration diamond drill program on its Midnight Crown granted claim on the western outskirts of Rossland, British Columbia. Of the initial drill holes completed, four drill cores have now been assayed by Assayers Canada, of Vancouver, B.C. and the Company is reporting the assay results from these holes, which are summarized in the table below. As a QA/QC grade control, all high grade samples (over 28 g/tonne Au) will be checked for confirmation by ALS Chemex Laboratory, of Vancouver, B.C. In the previous drill program and the current program on the Company’s properties, the Company encountered various quantities of gold, including a weighted average of 30.45 g/tonne Au over 5.7 m (18.5 feet) to 75 g/tonne Au over 1.06 m (3.5 feet) at hole SR06-8 (which was drilled in the earlier drill program and reported in a Company press release dated October 10, 2006) and in the recently completed drill hole MN09-4, a gold intersection with a weighted average of 34.37 g/tonne Au over 2.7 m (8.9 feet). Based on the 2009 drill core results achieved to date, the Company is encouraged with the results obtained from the program which continues to identify multiple zones of gold and silver mineralization on the Company’s properties. In the 2009 program, the Company plans to complete a drill hole grid on its Midnight property in order to allow the Company to proceed with a resource study pursuant to National Instrument 43-101.

Report on Magnesium

As previously reported, the Company completed and filed a National Instrument 43-101 Technical Report that established a substantial resource of Magnesium on the Company’s Record Ridge South property. In earlier reports, the Company also advised that it wished to proceed with a conceptual mining plan for a large, open pit quarry area to mine the Magnesium in its Record Ridge South property. Subject to the Company securing additional financing, SRK Consulting (US) Inc. (“SRK”) of Denver, Colorado recommended in its report that the Company proceed with a three phase drilling program targeting resource expansion and geotechnical data collection, conduct further metallurgical test work and complete a scoping level economic evaluation. The first phase of the drilling program will focus on the unconfined portions of the higher-grade resource located in the north-western portion of the Company’s property and will also test the undrilled material located between the two zones of known mineralization. When completed, this study should provide more geotechnical data for an open pit mine design.

The second phase of drilling will include several triple wall core holes located in the conceptual pit walls to obtain enough data to support a preliminary pit slope design.

The third phase of drilling will focus on the unconfined mineralization in the Company’s Ivanhoe South property. The drilling programs may run sequentially or concurrently depending on financing and time lines. Based on the results of the variography and geologic modeling, the drill hole spacing can be expanded to 100 m separation and still support an indicated resource. Metallurgical test work will focus on optimization of the processes delineated in the preliminary studies, including bond work index determinations, closed cycle test work and reagent consumption predictions, all resulting in a conceptual mill flow sheet. The scoping level economic evaluation will be initiated at the conclusion of the drilling and metallurgical test work. The scoping study will include an updated resource estimate incorporating the results of the new drilling, conceptual mining plan, site layout, metallurgical studies and mill plan. This data will form the basis of a preliminary economic model of the project.

The Company plans on commencing the first phase of the Magnesium drilling program in the spring of 2010 with 20 drill holes planned with an estimated cost of

$1,500,000 which includes project management and general overhead costs. The second phase geotechnical drilling program (six pit well drill holes) will be commenced immediately upon the completion of the first phase with an estimated cost of $500,000. The third phase drilling program is more extensive and will involve step out drilling of 15 holes with an estimated cost of $1,165,000 to be followed by a metallurgical study with an estimated cost of $150,000. All three phases will be completed within 18 months of the commencement date.

Private Placement

The Company also announces that, subject to regulatory and TSX Venture Exchange approval, it is proceeding with a private placement on a best-efforts basis (the “Private Placement”) of a minimum of $500,000 up to a maximum of $1,000,000 of Units at a price of $1.45 per Unit. Each Unit will be comprised of two (2) Flow- Through Common Shares (the “Flow-Through Shares”) priced at $0.50 per share and one (1) Common Share (the “Common Shares”) priced at $0.45 per share. The Units are being sold to enable the Company to continue to explore for gold on its Midnight property. The closing of the Private Placement is expected to take place on or before September 11, 2009. All securities issued pursuant to the Private Placement will be subject to a four month hold pursuant to applicable securities legislation.

About West High Yield

West High Yield is a publicly traded junior mining exploration company focused on the acquisition, exploration and development of mineral resource properties in Canada with a primary objective to locate and develop economic gold, nickel, and magnesium properties. The Company’s operations are being conducted on the Rossland Gold Camp property which is situated approximately 2.5 kilometers west of the town of Rossland, B.C. The Company controls approximately 6,316 contiguous hectares of mineral and crown granted claims and is exploring on its primary properties which are the Midnight, OK and IXL crown grants. Historically, under previous ownerships, these properties experienced gold production from narrow quartz veins with high grade gold content.

The Company’s field activities are supervised and the technical data for this report was prepared by H. Kim, P.Geo/P.Eng (Practicing) and assisted by Cory Peck, B.Sc, Geol.I.T. Mr. Kim is a qualified person as defined by National Instrument 43-101 (“NI 43-101”).

READER ADVISORY

This news release may contain certain forward-looking statements, including management’s assessment of future plans and operations, and capital expenditures and the timing thereof, that involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company’s control. Such risks and uncertainties include, without limitation, risks associated with mining exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of reserve estimates, environmental risks, competition from other explorers and producers, inability to retain drilling rigs and other services, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources, the impact of general economic conditions in Canada, the United States and overseas, industry conditions, changes in laws and regulations (including the adoption of new environmental laws and regulations) and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, fluctuations in foreign exchange or interest rates, stock market volatility and market valuations of companies with respect to announced transactions and the final valuations thereof, and obtaining required approvals of regulatory authorities. The Company’s actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits, including the amount of proceeds, that the Company will derive therefrom. Readers are cautioned that the foregoing list of factors is not exhaustive. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

42,080,794 Common Shares Issued

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact

West High Yield (W.H.Y.) Resources Ltd. Frank Marasco

President and Chief Executive Officer

(403) 660-3488

(403) 206-7159 (FAX)

Email: [email protected] or

West High Yield (W.H.Y.) Resources Ltd. Dwayne Vinck

Chief Financial Officer

(403) 257-2637

(403) 206-7159 (FAX)

Email: [email protected] or

West High Yield (W.H.Y.) Resources Ltd. 28 Arbour Lake Drive N.W.,

Calgary, Alberta T3G 3N8