February 24, 2009

NOT FOR DISSEMINATION IN THE UNITED STATES OR TO US PERSONS.

West High Yield (W.H.Y) Resources Ltd. (“West High Yield” or the “Company”) (TSX VENTURE:WHY) announces that it has filed a National Instrument 43-101 Technical Report that establishes a substantial resource of Magnesium at the Company’s Record Ridge South property located in Rossland, British Columbia (the “Project”). Copies of the Technical Report are available on the System for Electronic Document Analysis and Retrieval at www.sedar.com. The Technical Report was prepared by Dr. Bart Stryhas, PhD, CPG, a principal resource geologist with SRK Consulting (US), Inc. of Denver, Colorado (“SRK”). The property is an intermediate-advanced stage Magnesium exploration project, currently tested by 51 diamond drill holes. It is located approximately 7.5 km west-southwest of the town of Rossland. The Project mineralization is centered about 49 degrees 02′ 33″ N latitude and 117 degrees 53′ 22″ W longitude (UTM coordinates 5,432,500 N and 434,500 E).

Ownership

The West High Yield claim block consists of 19 contiguous mineral claims covering 6,134 hectares plus 8 crown granted and one private ownership claim (9 titles) totalling 212 hectares. The Magnesium mineralization of the Project is located within two mineral claims. The northern part is located within claim # 514607 (Frank SR 3) which covers 317.6 hectares. This claim was originally located by the Company on June 16, 2007 and is in good standing until February 28, 2019. The southern portion of the mineralization is located on claim #513794 (Hidden Valley 3) which covers 127 hectares. This claim was originally located by the Company on June 2, 2005 and is in good standing until February 28, 2019.

Geology and Mineralization

The Record Ridge South area is located within the Quesnel Terrain of the Intermontaine Tectonic Belt. It is comprised of a highly deformed Jurassic (180ma) age volcanic island arc back arc basin complex intruded by Tertiary volcanic and plutonic rocks. The exploration area is underlain primarily by the Record Ridge Ultramafic Body. This unit is bound on the north by the volcanics of the Tertiary Marron Formation, on the east and southeast by the volcanic rocks of the Jurassic Elise Formation and on the west and southwest by the Tertiary age Coryell intrusive suite. Regional metamorphism has reached greenschist facies in the Record Ridge South area.

The Record Ridge ultramafic body constitutes the mineralization hosting the Magnesium resource of the Technical Report. The body underlies an area of approximately 6.2km2, extending from the southern tip of Record Ridge, south to the foot of Mount Sophia and east to Ivanhoe Ridge. The rock type consists of variably serpentinized and locally carbonatized ultramafic cumulates. Lithic types include; dunite, pyroxene-bearing dunite, olivine-bearing wehrlite and wehrlite, each type varying simply as a function of the relative proportion of olivine to pyroxene. On fresh surfaces, the unit is very fine grained with a black color. It also contains abundant veinlets of light green to bluish serpentinite. The unit weathers to a brown color and stands out as open outcrops with a distinctive lack of vegetation in the nearby soils.

Exploration

During the 2007 and 2008 field seasons, the Company conducted surface mapping, surface sampling and diamond drilling on the Project. The surface mapping was conducted at a 1:2,500 Scale focused on the ultramafic rocks. Samples were collected from outcrop and analyzed by ICPAES for 24 elements. A total of 30 sample were collected and analyzed. The results of this work delineated a portion of the ultramafic body with high Magnesium.

The anomalous zone was then drill tested by 51 diamond core drill holes during 2007 and 2008. These were carefully logged and sampled and then tested with 24 element ICP-AES analysis. The exploration work conducted by the Company meets current industry standards. All drill core logging and sampling has been done by trained and professional personnel. The Company has made a concerted effort to ensure good sample quality and has maintained a careful chain of core custody from the drill rig to the assay laboratory.

Resource Estimation

The Project resource estimation is based on information from 51 drill holes totaling 6,340 metres. The drill hole database was compiled and verified by SRK and is determined to be of high quality. A geologic model was constructed based on three general rock groups. Three-dimensional solids were constructed to limit the outer boundary of mineralization and to delineate two internal waste rocks. These solids were used to assigned rock types to the block model. Each model block was then assigned a unique specific gravity based rock type. The model blocks are 15 metres x 15 metres x 5 metres in the x,y,z directions, respectively. All block grade estimates were made using 2.5 metres down hole composites. An Ordinary Kriging algorithm was employed using a minimum of 5 and a maximum of 15 composites within a search ellipsoid 150 metres x 150 metres x 25 metres in the x,y,z directions respectively.

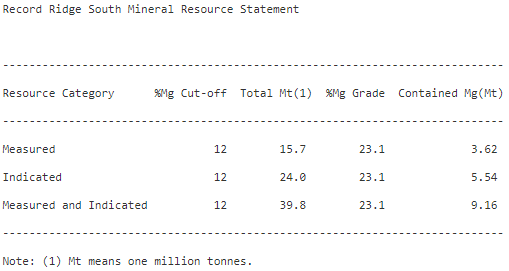

The results of the resource estimation provided a CIM classified Measured and Indicated Mineral Resource as reported in the table below. SRK advised that the quality of the Project drilling and data is very good and the Mineral Resource was classified mainly according to the general drill hole spacing.

Conceptual Mining Plan

The Record Ridge South resource area will essentially be a large open pit quarry area that would supply material with significantly elevated Magnesium levels to an energy-intensive (electricity and natural gas) processing plant to comminute the mineralized rock, leach, dry, separate through electrolysis methods and package the Magnesium metal for shipment to domestic and foreign markets. Investigation to date shows that the Record Ridge South Resource could support an open pit mine and Magnesium processing facility, which are contingent on the long-term price of Magnesium metal, energy prices and reagent prices and capital costs.

Conclusions and Recommendations

Subject to the Company securing additional financing, SRK has recommended and the Company plans to conduct a three phase drilling program targeting resource expansion and geotechnical data collection, conduct further metallurgical test work and complete a scoping level economic evaluation. The first phase of the drilling program will focus on the unconfined portions of the higher-grade resource located in the northwestern portion of the current drilling and will also test the undrilled material located between the two zones of known mineralization. SRK has also recommended that the Company should provide more geotechnical data for an open pit mine design. The second phase of drilling will include several triple wall core holes located in the conceptual pit walls to obtain enough data to support a preliminary pit slope design. The third phase of drilling will focus on the unconfined mineralization in the Ivanhoe South area. The drilling programs may run sequentially or concurrently depending on financing and time line. Based on the results of the variography and geologic modeling, the drill hole spacing can be expanded to 100 metre separation and still support an indicated resource. Metallurgical test work will focus on optimization of the processes delineated in the preliminary studies, including bond work index determinations, closed cycle test work and reagent consumption predictions, all resulting in a conceptual mill flow sheet.

The scoping level economic evaluation will be initiated at the conclusion of the drilling and the metallurgical test work. The scoping study will include an updated resource estimate incorporating the results of the new drilling, conceptual mining plans, site layout, metallurgical studies and mill plans. This data will form the basis of a preliminary economic model.

The price of Magnesium has increased considerably since 2006. During 2007, free market prices in Canada and Europe increased sharply from $0.95 US per pound to $1.80 US per pound. The current price in early January, 2009 is approximately $2.30 US per pound. Corresponding prices in the USA are significantly higher due to varying tariff protection against certain Chinese and Russian producers. Management of the Company believes that demand for Magnesium will remain strong, particularly from the auto industry where high gasoline prices are leading to the design of lighter more fuel efficient vehicles.

About West High Yield

West High Yield is a publicly traded junior mining exploration company focused on the acquisition, exploration and development of mineral resource properties in Canada with a primary objective to locate and develop economic gold, nickel, and magnesium properties.

Dr. Bart Stryhas, PhD, CPG of SRK is the independent Qualified Person who prepared the 43-101 Technical Report on the Record Ridge South property and has reviewed and approved the contents of this press release. The Company’s field activities are supervised by H. Kim, P.Geo/P.Eng (Practicing), the Company’s on-site Geologist.

READER ADVISORY

This news release may contain certain forward-looking statements, including management’s assessment of future plans and operations, and capital expenditures and the timing thereof, that involve substantial known and unknown risks and uncertainties, certain of which are beyond the Company’s control. Such risks and uncertainties include, without limitation, risks associated with mining exploration, development, exploitation, production, marketing and transportation, loss of markets, volatility of commodity prices, currency fluctuations, imprecision of reserve estimates, environmental risks, competition from other explorers and producers, inability to retain drilling rigs and other services, delays resulting from or inability to obtain required regulatory approvals and ability to access sufficient capital from internal and external sources, the impact of general economic conditions in Canada, the United States and overseas, industry conditions, changes in laws and regulations (including the adoption of new environmental laws and regulations) and changes in how they are interpreted and enforced, increased competition, the lack of availability of qualified personnel or management, fluctuations in foreign exchange or interest rates, stock market volatility and market valuations of companies with respect to announced transactions and the final valuations thereof, and obtaining required approvals of regulatory authorities. The Company’s actual results, performance or achievements could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurances can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits, including the amount of proceeds, that the Company will derive therefrom. Readers are cautioned that the foregoing list of factors is not exhaustive. All subsequent forward-looking statements, whether written or oral, attributable to the Company or persons acting on its behalf are expressly qualified in their entirety by these cautionary statements. Furthermore, the forward-looking statements contained in this news release are made as at the date of this news release and the Company does not undertake any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws.

40,830,794 Common Shares Issued

The TSXV has neither approved nor disapproved the contents of this news release. The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this release.

For more information, please contact

West High Yield (W.H.Y.) Resources Ltd.

Frank Marasco

President and Chief Executive Officer

(403) 660-3488

(403) 206-7159 (FAX)

Email: [email protected]

or

West High Yield (W.H.Y.) Resources Ltd.

Dwayne Vinck

Chief Financial Officer

(403) 257-2637

(403) 206-7159 (FAX)

Email: [email protected]

or

West High Yield (W.H.Y.) Resources Ltd.

28 Arbour Lake Drive N.W.

Calgary, Alberta T3G 3N8